Analyzing Alcoa’s 2019 Outlook

On paper, aluminum’s fundamentals look strong. Aluminum markets were expected to be in a deficit of 1.5 million metric tons last year.

Feb. 25 2019, Updated 4:30 p.m. ET

Alcoa’s 2019 outlook

In the previous part, we discussed Alcoa’s valuation and earnings estimates. In this part, we’ll discuss Alcoa’s outlook after a reasonably strong start to 2019. Alcoa’s fortunes are closely tied to the commodities it sells—mainly bauxite, alumina, and aluminum (XME).

Alumina

Last year, alumina markets were rattled with supply disruptions. The curtailment of Norsk Hydro’s Alunorte refinery and sanctions against RUSAL disrupted alumina markets, which led to a spike in alumina prices (AWC). Now, alumina prices have stabilized. Lower alumina prices should dent integrated aluminum producers’ earnings like Alcoa (AA) and Rio Tinto (RIO). However, companies like Century Aluminum (CENX), which buy alumina from third parties, could gain from lower alumina prices. There don’t appear to be many bullish drivers for alumina given the current alumina-to-aluminum ratio. The ratio is still high by historical standards.

Aluminum

On paper, aluminum’s fundamentals look strong. Aluminum markets were expected to be in a deficit of 1.5 million metric tons last year. Century Aluminum expects a similar deficit this year. Official and unofficial aluminum stocks have come down amid massive deficits.

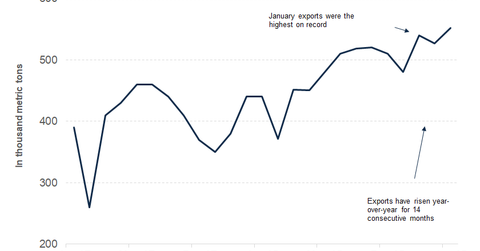

There are a few other drivers. China’s aluminum demand growth is expected to be muted this year. Globally, automotive sales’ growth rates have come down, which could hamper the growth rates for aluminum demand. On the supply side, China’s aluminum exports have kept rising and made a new record in January.

For Alcoa, the margin of safety looks much lower compared to its lows in December. While a US-China trade deal could trigger some upside in metal and mining companies, China might need to do a lot more to address the slowdown.