A Look at the Basic Materials Sector’s Dividend Yield

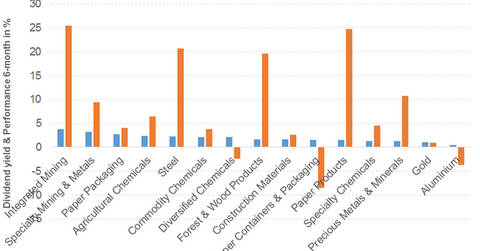

Of the various industries in the basic materials sector, integrated mining noted the highest dividend yield.

Jun. 8 2018, Published 2:58 p.m. ET

Basic materials industries

Of the various industries in the basic materials sector, integrated mining noted the highest dividend yield. Only integrated mining, specialty mining and metals, and paper packaging have beaten the broad-based indexes’ dividend yields.

Industries within this sector and the top dividend payer under the respective industry are as follows:

- integrated mining with a dividend yield of 3.9% and Rio Tinto (RIO)

- specialty mining and metals with a dividend yield of 3.2% and Vedanta (VEDL)

- paper packaging with a dividend yield of 2.9% and International Paper Company (IP)

- steel with a dividend yield of 2.4% and POSCO (PKX)

- agricultural chemicals with a dividend yield of 2.2% and Monsanto (MON)

- diversified chemicals with a dividend yield of 2.2% and DowDuPont (DWDP)

- commodity chemicals with a dividend yield of 2.1% and LyondellBasell Industries (LYB)

- forest and wood products with a dividend yield of 1.8% and Norbord (OSB)

- construction materials with a dividend yield of 1.7% and CRH (CRH)

- non-paper containers and packaging with a dividend yield of 1.5% and Avery Dennison (AVY)

- paper products with a dividend yield of 1.5% and Fibria Celulose (FBR)

- specialty chemicals with a dividend yield of 1.3% and Ecolab (ECL)

- precious metals and minerals with a dividend yield of 1.3% and Wheaton Precious Metals (WPM)

- gold with a dividend yield of 1.2% and Harmony Gold Mining Company (HMY)

- aluminum with a dividend yield of 0.5% and Arconic (ARNC)

Agricultural chemicals and gold ended in the red on June 1. Non-Paper containers and packaging, aluminum, diversified chemicals, and gold generated negative six-month returns.

Going forward

Lower prices for corn, wheat, and soybeans have capped the prices of seeds, crop-protection chemicals, and fertilizers, which contributed to low stock prices. Favorable weather conditions contributed to higher crop yields and stock supply, which affected prices. The sector has seen several mergers and acquistions, which are expected to propel the sector forward.

Dividend ETFs

The FlexShares Quality Dividend Index Fund (QDF) offers a dividend yield of 2.5% at a PE of 22.2x. It has 22% and 3% exposure to technology and basic materials, respectively. The iShares International Select Dividend ETF (IDV) offers a dividend yield of 4.5% at a PE of 13.5x. It has 31% and 2% exposure to financials and basic materials, respectively.