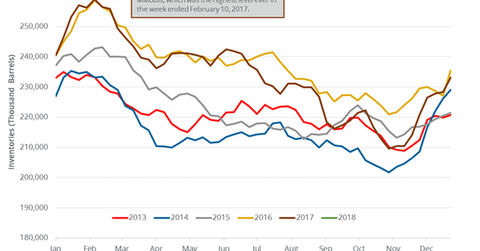

US Gasoline Inventories: More Concerns for Oil in 2018?

US gasoline inventories rose by 4.1 MMbbls (million barrels) to 237.3 MMbbls between December 29, 2017, and January 5, 2018.

Jan. 11 2018, Updated 10:35 a.m. ET

Weekly US gasoline inventories

US gasoline inventories rose by 4.1 MMbbls (million barrels) to 237.3 MMbbls between December 29, 2017, and January 5, 2018, according to the EIA. Inventories rose 1.7% week-over-week but fell by 3.2 MMbbls or 1.3% YoY (year-over-year).

Market surveys expected that US gasoline inventories would have risen by 2.6 MMbbls between December 29, 2017, and January 5, 2018. Gasoline futures fell 0.2% to $1.8 per gallon on January 10, 2018, due to the larger-than-expected rise in gasoline inventories. US gasoline futures (UGA) and US crude oil (UWT) (SCO) diverged on January 10, 2018.

WTI oil (UCO) prices are at the highest level since December 2014. Moves in oil (DBO) prices impact energy producers (XES) (PXI) like PDC Energy (PDCE), Carrizo Oil & Gas (CRZO), and Stone Energy (SGY).

Similarly, volatility in gasoline prices impacts US refiners (CRAK) like Valero (VLO), CVR Energy (CVI), and Holly Frontier (HFC).

US gasoline production and demand

US gasoline production fell by 157,000 bpd (barrels per day) to 9,525,000 bpd between December 29, 2017, and January 5, 2018, according to the EIA. Production fell 1.6% week-over-week and by 141,000 bpd or 1.5% YoY.

US gasoline demand rose by 164,000 bpd to 8,814,000 bpd between December 29, 2017, and January 5, 2018. Demand rose 1.9% week-over-week and by 344,000 bpd or 4.1% YoY. The increase in gasoline demand is bullish for gasoline and oil (USL) prices.

Impact

US gasoline inventories increased for the ninth consecutive week. Inventories rose by 27.7 MMbbls or 13.2% during this period. If the momentum continues in 2018, it could weigh on gasoline and crude oil (USO) prices. It could also be one of crude oil’s bearish drivers in 2018.

US gasoline inventories were ~1% above their five-year average. If the difference increases, it’s a bearish sign for gasoline and oil (DBO) prices.

Next, we’ll discuss US distillate inventories.