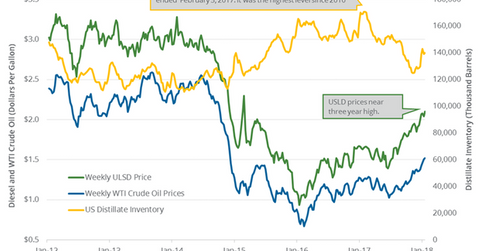

US Distillate Inventories Rose for the Eighth Time in 10 Weeks

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA.

Nov. 20 2020, Updated 2:59 p.m. ET

US distillate inventories

US distillate inventories rose by 0.64 MMbbls (million barrels) to 139.8 MMbbls on January 12–19, 2018, according to the EIA. Inventories increased 0.5% week-over-week but decreased by 29.3 MMbbls or 17% YoY (year-over-year).

Wall Street analysts estimated that US distillate inventories could have declined by 1.5 MMbbls on January 12–19, 2018. US diesel futures rose 1% to $2.10 per gallon on January 24, 2018. US crude oil (USO) (SCO) and diesel futures moved together on January 24, 2018.

US crude oil (DWT) prices are at a three-year high. It benefits energy producers (RYE) (VDE) like Newfield Exploration (NFX), Whiting Petroleum (WLL), Parsley Energy (PE), and SN Energy (SN).

Diesel prices are near three-year highs, which favors US refiners (CRAK) like CVR Energy (CVI), Phillips 66 (PSX), and PBF Energy (PBF).

US distillate production and demand

US distillate production declined by 249,000 bpd (barrels per day) to 4,827,000 bpd on January 12–19, 2018, according to the EIA. Production decreased 5% week-over-week but increased by 252,000 bpd or 5.5% YoY.

US distillate demand decreased by 891,000 bpd to 3.9 MMbpd on January 12–19, 2018. Demand decreased 18.8% week-over-week but increased by 202,000 bpd or 5.5% YoY. The YoY increase in distillate demand is bullish for diesel and oil (SCO) prices.

Impact

US distillate inventories rose for the eighth time in the last ten weeks. Inventories increased ~12.1% during the same period, which is bearish for diesel and oil (UWT) prices.

US distillate inventories are 2.8% below their five-year average, which is bullish for diesel and oil (DBO) prices. Any rise in US distillate inventories above the five-year average could have a negative impact on diesel and oil (UCO) prices.

Read Crude Oil Prices Could Hit $80 per Barrel in 2018 and Can OPEC and Natural Gas Production Support Natural Gas Bears? for updates on oil and gas.