Investment Banks’ Estimates for Crude Oil Prices in 2018

WTI crude oil (USL) prices are at their 30-month high. The US benchmark also opened above $60 per barrel in January for the first time since 2014.

Jan. 3 2018, Updated 11:00 a.m. ET

Moving averages

WTI crude oil (UCO) futures contracts for February delivery are above their 100-day, 50-day, and 20-day moving averages on January 2, 2018. It suggests that oil prices could trade higher.

WTI crude oil (USL) prices are at their 30-month high. The US benchmark also opened above $60 per barrel in January for the first time since 2014. Higher oil prices favor oil producers (PXI) like PDC Energy (PDCE) and Cobalt International Energy (CIE).

Crude oil price forecasts

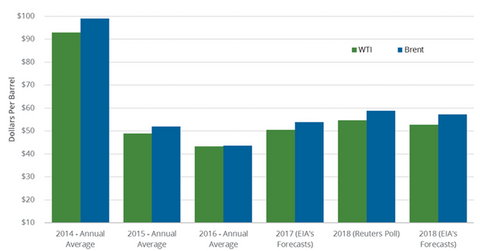

In December 2017, a Wall Street Journal survey of 15 investment banks estimated that Brent crude oil prices would average $58 per barrel in 2018. Brent crude oil prices averaged ~$54 per barrel in 2017. The survey also estimated that US crude oil prices are expected to average $54 per barrel in 2018. US crude oil (DBO) prices averaged ~$51 per barrel in 2017.

The production cut extension until December 2018, improving global oil demand, rising geopolitical tension in the Middle East, and unplanned supply outages will support oil prices in 2018. However, the rise in US and non-OPEC oil supplies in 2018 will weigh on oil prices.

Brent (BNO) and WTI crude oil (UCO) prices would average $57.26 per barrel and $52.77 per barrel in 2018, according to the EIA.

A Reuters survey estimated that Brent and WTI oil (USO) prices would average $58.84 per barrel and $54.78 per barrel in 2018, respectively.

Read Will Crude Oil Futures Test a 3-Year High in 2018? and Will US Natural Gas Futures Start 2018 on a Positive Note? for updates on oil and gas.