Will Crude Oil Prices Start 2018 on a Positive Note?

A Reuters survey estimated that Brent and US crude oil prices could average $58.84 per barrel and $54.78 per barrel in 2018.

Nov. 20 2020, Updated 2:18 p.m. ET

Moving averages

February WTI crude oil (USO) futures contracts are above their 20-day, 50-day, and 100-day moving averages on December 26, 2017. It indicates that prices could trade higher.

Any fall in US crude oil inventories and an unplanned supply outage could push crude oil (DBO) prices higher. All of these factors suggest that crude oil prices could start 2018 on a positive note. However, any rise in US crude oil production could cap the upside for crude oil (UWT) prices. The EIA will release US crude oil production data on December 28, 2017.

Crude oil price forecasts

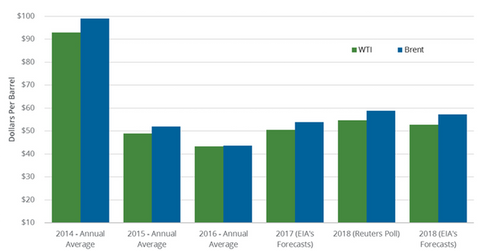

Investment bank Jefferies estimates that Brent and WTI oil price are expected to average $63 per barrel and $59 per barrel in 2018. It expects that the fall in global crude oil inventories below the five-year average in 3Q18 will help oil prices.

The production cut extension and improving global crude oil demand will support oil prices in 2018. However, the rise in non-OPEC oil supplies in 2018 will pressure oil prices.

The EIA estimated that the Brent (BNO) and US crude oil (SCO) prices could average $57.26 per barrel and $52.77 per barrel in 2018.

A Reuters survey estimated that Brent and US crude oil prices could average $58.84 per barrel and $54.78 per barrel in 2018.

A Wall Street Journal survey estimated that Brent and US crude oil prices are expected to average $56 per barrel and $53 per barrel in 2018.

Read Will Crude Oil Prices Hit a 3-Year High? and Will US Natural Gas Futures End 2017 on a Low Note? for updates on oil and gas.