US Gasoline Inventories: Turning Point for Crude Oil Futures?

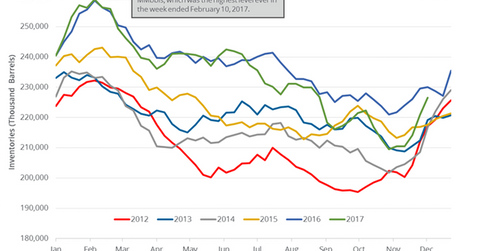

US gasoline inventories rose by 5.6 MMbbls (million barrels) or 2.6% to 226.5 MMbbls on December 1–8, 2017.

Dec. 14 2017, Published 8:14 a.m. ET

US gasoline inventories

US gasoline inventories rose by 5.6 MMbbls (million barrels) or 2.6% to 226.5 MMbbls on December 1–8, 2017. However, inventories fell by 3.4 MMbbls or 1.5% YoY (year-over-year).

Reuters surveys expected that US gasoline inventories would have risen by 2.5 MMbbls on December 1–8, 2017. Gasoline and crude oil (UCO) (SCO) futures fell on December 13, 2017, due to the massive build in gasoline inventories. US gasoline (UGA) futures fell 3% to $1.64 per gallon on December 13, 2017.

Crude oil prices are near a one-week low. Lower oil (UCO) prices have a negative impact on energy producers (FXN) (IXC) like Bill Barrett (BBG) and Bonanza Creek Energy (BCEI). Likewise, lower gasoline (UGA) prices have a negative impact on US refiners (CRAK) like Phillips 66 (PSX) and CVR Energy (CVI).

US gasoline production and demand

US gasoline production rose by 371,000 bpd (barrels per day) to 10.1 MMbpd (million barrels per day) on December 1–8, 2017, according to the EIA. Production rose 3.8% week-over-week and by 301,000 bpd or 3.1% YoY.

US gasoline demand rose by 196,000 bpd to 9.1 MMbpd on December 1–8, 2017. Demand rose 2.2% week-over-week and by 217,000 bpd or 2.4% YoY. The rise in gasoline demand is bullish for gasoline and oil (USO) prices.

Impact

US gasoline inventories increased for the fifth consecutive week. Inventories rose by 17 MMbbls or 8.1% during this period. If the momentum continues, it would add more pressure to gasoline and oil prices.

Gasoline inventories are also 3% above their five-year average for the week ending December 8, 2017. Any rise in gasoline inventories is bearish for gasoline and oil (UWT) prices.

Next, we’ll discuss US distillate inventories.