US Distillate Inventories Rose for the Fourth Time in 5 Weeks

US distillate inventories rose for the fourth time in the last five weeks. They rose ~3% in the last five weeks, which is bearish for diesel and oil prices.

Nov. 20 2020, Updated 4:29 p.m. ET

US distillate inventories

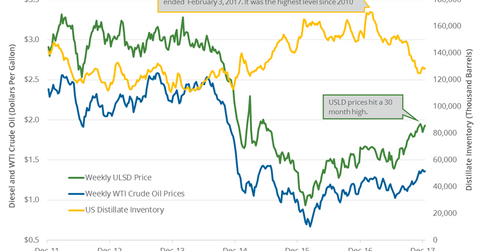

The EIA estimated that US distillate inventories rose by 0.7 MMbbls (million barrels) or 0.6% to 128.8 MMbbls on December 8–15, 2017. However, inventories fell by 25 MMbbls or 16% YoY (year-over-year).

Analysts expected that US distillate inventories could have fallen by 1.3 MMbbls on December 8–15, 2017. US diesel and oil (USO) (SCO) prices rose on December 20, 2017. US diesel futures rose 0.2% to $1.94 per gallon on December 20, 2017.

Higher diesel prices benefit US refiners (CRAK) like Holly Frontier (HFC) and PBF Energy (PBF). Similarly, higher oil (UCO) prices have a positive impact on energy producers (XLE) (VDE) like Bill Barrett (BBG), SM Energy (SM), and Bonanza Creek Energy (BCEI).

US distillate production and demand

US distillate production fell by 41,000 bpd (barrels per day) or 0.8% to 5.2 MMbpd (million barrels per day) on December 8–15, 2017. However, production rose by 84,000 bpd or 1.6% YoY.

US distillate demand fell by 454,000 bpd or 10% to 4.3 MMbpd on December 8–15, 2017. The demand also fell 14% or by 623,000 bpd YoY. The fall in distillate demand is bearish for diesel and oil (DWT) prices.

Impact

US distillate inventories rose for the fourth time in the last five weeks. They rose ~3% in the last five weeks, which is bearish for diesel and oil (USO) prices.

However, US distillate inventories are 3.2% below their five-year average, which is bullish for diesel and oil (USO) prices. Any fall in distillate inventories is bullish for diesel and oil prices.

Read Iran, Libya, and Global Oil Supply Outage Could Impact Oil Prices and Will US Natural Gas Futures Fall More? for updates on oil and gas.