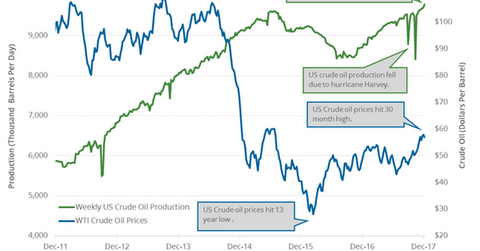

US Crude Oil Production Has Risen 16% since July 2016

US crude oil production rose by 73,000 bpd (barrels per day) to 9,780,000 bpd on December 1–8, 2017, according to the EIA.

Dec. 14 2017, Updated 12:58 p.m. ET

Weekly US crude oil production

US crude oil production rose by 73,000 bpd (barrels per day) to 9,780,000 bpd on December 1–8, 2017, according to the EIA. It’s the highest production level ever. Production rose 0.8% week-over-week and by 984,000 bpd or 11.2% from the same period in 2016. Production increased for the eighth consecutive week. News of strong production pressured oil (UWT) (SCO) prices on December 13, 2017.

Oil prices impact the Energy Select Sector SPDR ETF (XLE). XLE fell 0.14% to 69.49 on December 13, 2017.

US crude oil production lows

US crude oil production rose by 1,352,000 bpd (barrels per day) or 16% from the lows on July 1, 2016. It was the lowest production in more than two years. Production rose due to improving drilling costs and relatively higher oil prices in 2017—compared to 2016. Higher oil prices benefit oil producers (IEZ) (IXC) like Whiting Petroleum (WLL), W&T Offshore (WTI), and Contango Oil & Gas (MCF).

US crude oil production estimates for 2018

OPEC estimates that US crude oil production is expected to increase by 1,050,000 bpd in 2018 from 2017. According to the EIA, US production could average ~10, 020,000 bpd in 2018. It would be the highest annual production average ever.

Output cuts and US crude oil production

OPEC extended the output cuts until December 2018. US oil production has risen by 834,000 bpd or 9.3% from January 2017 to December 8, 2017. It has offset ~46% of the output cuts.

Impact

US production might offset ~1,000,000 bpd or ~55% of the ongoing output cuts in 2018. It would weigh on oil (DWT) prices in 2018.

Next, we’ll discuss US gasoline inventories.