US Crude Oil and Oil ETFs: Which One Is Rising More?

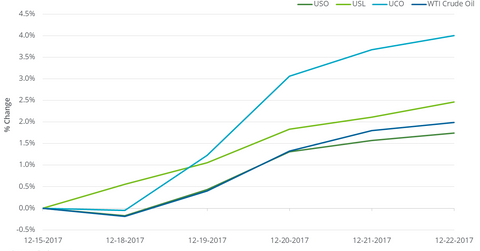

From December 15–22, 2017, the United States Oil ETF (USO) rose 1.7%. USO holds US crude oil near-month futures contracts.

Dec. 26 2017, Updated 1:50 p.m. ET

Oil ETFs

From December 15–22, 2017, the United States Oil ETF (USO) rose 1.7%. USO holds US crude oil near-month futures contracts. Over that period, US crude oil February 2018 futures rose 30 basis points more than USO.

In the seven calendar days to December 22, 2017, the United States 12-Month Oil ETF (USL), which holds US crude oil futures contracts between February 2018 and January 2019, rose 2.5%. The ProShares Ultra Bloomberg Crude Oil (UCO), whose aim is to capture twice the daily changes of the Bloomberg WTI Crude Oil Subindex, gained two times more than US crude oil futures.

Since February 2016

Between February 11, 2016, and December 22, 2017, US crude oil (DBO) (OIIL) active futures have risen more than two times from their 12-year low. Oil prices touched that low on February 11, 2016. However, USO, USL, and UCO rose 45.9%, 43.5%, and 69.9%, respectively, after oil prices fell to their lows.

The negative roll yield could have created this difference between oil ETFs and US crude oil futures returns. The roll yield is defined by the difference in prices of two consecutive futures contracts. So the roll yield would be negative if active futures traded less than next month’s futures. Read How Oil Prices Have Reacted to Oversupply Concerns to know more.

On December 22, 2017, US crude oil futures contracts between April 2018 and January 2019 settled progressively lower. Some believe it could be an advantage for these ETFs.

The compounding effect of daily changes in price could make the actual returns vary from the expected returns in the case of UCO.