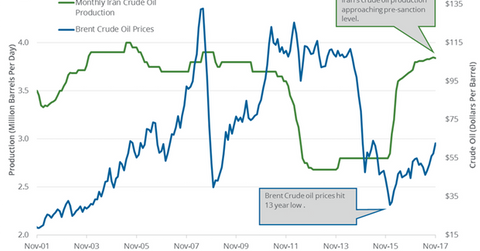

Iran’s Crude Oil Production Is near a 9-Year High

The EIA estimates that Iran’s crude oil production fell by 10,000 bpd or 0.3% to 3,840,000 bpd in November 2017—compared to the previous month.

Dec. 20 2017, Updated 8:30 a.m. ET

Iran’s crude oil production

The EIA estimates that Iran’s crude oil production fell by 10,000 bpd (barrels per day) or 0.3% to 3,840,000 bpd in November 2017—compared to the previous month. However, production rose by 140,000 bpd or 3.7% year-over-year.

Iran’s oil production was a near nine-year high. Production rose after the US lifted sanctions on the country in January 2016. Any rise in production from Iran is bearish for oil (UCO) (BNO) prices.

Iran is the third-largest oil producer among OPEC countries. Iran’s crude oil production rose by 990,000 bpd or 35% between January 2016 and November 2017. High production has a negative impact on oil (USL) prices. Energy producers (RYE) (IXC) like SM Energy (SM), Noble Energy (NBL), and Apache (APA) are impacted negatively by lower oil prices.

Iran and the production cut deal

Iran supported the extension of production cuts until December 2018. OPEC allowed Iran to increase its crude oil production slightly to help it recover market share lost while it was under US sanctions. Iran is allowed to cap production at ~3,800,000 bpd. If Iran shows any lower compliance to the production cut deal, it would pressure oil (DBO) (USO) prices.

Iran’s crude oil production plans

Iran’s oil production averaged 3.5 MMbpd (million barrels per day) and 2.8 MMbpd in 2016 and 2015, respectively. Production averaged 3.8 MMbpd in the first 11 months of 2017. Iran plans to increase the production to 4.7 MMbpd by 2021. Any rise in production from Iran could pressure oil (SCO) prices.

Next, we’ll discuss how Libya’s crude oil production impacts crude oil prices.