Are Crude Oil Prices Losing Bullish Momentum?

Record US crude oil production is limiting the upside for crude oil prices. US oil prices fell ~3% from the high in November 2017.

Dec. 19 2017, Updated 10:45 a.m. ET

Moving averages

US crude oil futures contracts for February delivery were above their 50-day and 100-day moving averages on December 18, 2017. It suggests that prices could trend higher.

However, record US crude oil production is limiting the upside for crude oil prices. US oil prices fell ~3% from the high in November 2017. The EIA will release US crude oil production data on December 20, 2017. Any rise in US crude oil production would pressure oil (UWT) (DWT) (UCO) prices.

Crude oil price forecasts

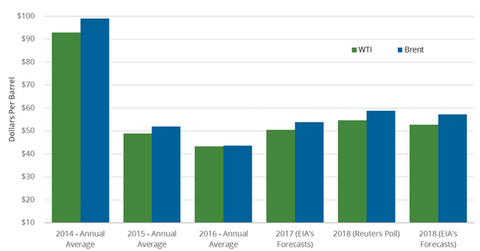

The EIA released its STEO (Short-Term Energy Outlook) report on December 12, 2017. It estimates that the US (DBO) (USL) could average $52.77 per barrel in 2018—3.4% higher than the November STEO estimates.

The EIA also estimated that Brent crude oil prices could average $57.26 per barrel in 2018—3% higher than the November STEO estimates.

A Reuters survey estimated that US crude oil (UCO) prices could average $54.78 per barrel in 2018. Similarly, Brent (BNO) crude oil prices could average $58.84 per barrel in 2018, according to Reuters.

The production cut extension and higher compliance with the production cut will help oil prices in 2018. Improving global oil demand and lower US and global crude oil inventories will also help oil prices. However, the rise in non-OPEC crude oil supplies in 2018 will be the biggest bearish driver for oil prices.

Read Which Factors Could Limit the Upside for Crude Oil Futures? and Will US Natural Gas Futures Fall More? for updates on oil and gas.