Will Russia Comply with the Crude Oil Production Cut Pact?

On November 24, 2017, Russia said that it would support extending the production cut beyond March 2018.

Nov. 28 2017, Published 9:16 a.m. ET

Crude oil futures

January WTI (West Texas Intermediate) crude oil (UWT) (SCO) futures contracts fell 0.6% and were trading at $57.77 per barrel in electronic trading at 12:56 AM EST on November 28, 2017. Likewise, E-Mini S&P 500 (SPY) futures contracts for December delivery fell 0.10% to 2,599.25 during the same time.

WTI crude oil (USO) (SCO) prices fell ahead of the American Petroleum Institute’s crude oil inventory report. The report will be published on November 28, 2017. Any fall in inventories is bullish for oil (DWT) (DBO) prices. WTI oil prices have risen 21% in the last three months. Higher oil prices benefit funds like the Guggenheim S&P 500 Equal Weight Energy ETF (RYE) and the Energy Select Sector SPDR (XLE). These ETFs rose 7.6% and 6.6% in the last three months.

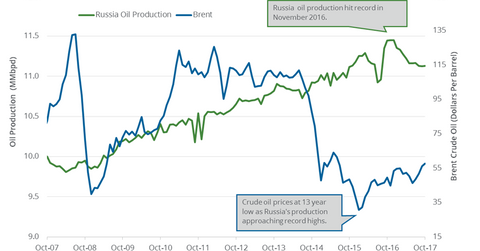

Russia’s crude oil production and production cuts

Russia’s crude oil production rose by 20,000 bpd (barrels per day) to 10,930,000 bpd in October 2017—compared to the previous month. Russia’s production fell by 317,000 bpd or 2.8% as of October 2017 from the same period in 2016. Russia decided to cut the crude oil production by 300,000 bpd as part of the ongoing production cuts. On November 24, 2017, Russia said that it would support extending the production cut beyond March 2018.

Russia’s crude oil production plans

ExxonMobil’s (XOM) is one of the partners in developing the Sakhalin-1 project in Russia. The project could lead to a rise in crude oil production by 25% or 255,000 bpd starting in January 2018. If production increases in January 2018, it would be hard for Russia to comply with ongoing production cuts and even the extension. Any rise in crude oil production from Russia is bearish for crude oil (DTO) (OIL) (BNO) prices. Lower oil prices would pressure oil producers’ (IEZ) (PXI) earnings like BP (BP), Shell (RDS.A), Rosneft, and Saudi Aramco.

Russia and OPEC will meet in Vienna on November 30 to discuss extending the production cuts beyond March 2018—possibly until December 2018. Read Part 4 of this series to learn more about OPEC’s meeting.

Next, we’ll discuss how Libya’s crude oil production influences oil prices.