US Crude Oil Inventories: Bearish Driver for Crude Oil

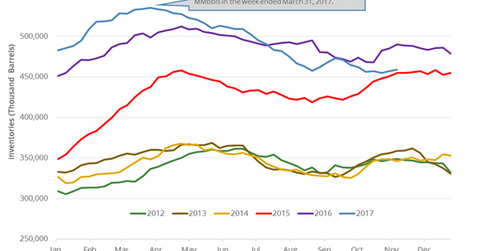

The EIA estimates that US oil inventories rose by 1,854,000 barrels to 458.9 MMbbls (million barrels) on November 3–10, 2017.

Nov. 20 2020, Updated 4:29 p.m. ET

US crude oil inventories

The EIA released its weekly crude oil inventory report on November 15, 2017. It estimates that US oil inventories rose by 1,854,000 barrels to 458.9 MMbbls (million barrels) on November 3–10, 2017. Crude oil inventories rose 0.4% week-over-week but fell by 31.2 MMbbls or 6.3% year-over-year. Inventories rose for the second straight week.

Wall Street analysts expected US crude oil inventories to fall by 2,200,000 barrels on November 3–10, 2017. An unexpected build in US crude oil inventories weighed on oil (DBO) (USO) (BNO) prices on November 15, 2017.

US crude oil (UCO) (UWT) prices are at a ten-day low. However, they hit a 30-month high on November 6, 2017, due to several bullish drivers. Changes in oil prices impact energy producers (FXN) (RYE) like Pioneer Natural Resources (PXD), Devon Energy (DVN), Gulfport Energy (GPOR), and Occidental Petroleum (OXY).

US crude oil inventories by region

The EIA divides the US into five storage regions. Let’s analyze the changes in crude oil inventories on November 3–10, 2017.

- East Coast inventories fell by 0.1 MMbbls to 14 MMbbls.

- Midwest inventories were flat at 150.6 MMbbls.

- Gulf Coast inventories rose by 2.9 MMbbls to 221.6 MMbbls.

- Rocky Mountain inventories fell by 0.7 MMbbls to 20.6 MMbbls.

- West Coast inventories fell by 0.4 MMbbls to 52.1 MMbbls.

Impact of US crude oil inventories

US crude oil inventories have fallen ~14% from their all-time high in March 2017, which will have a positive impact on oil (BNO) (SCO) prices. However, US crude oil inventories are ~60 MMbbls or 15.0% above the five-year average for the week ending November 10, 2017, which will pressure oil (DTO) (OIL) prices. US crude oil inventories are the biggest bearish driver for oil after US crude oil production.