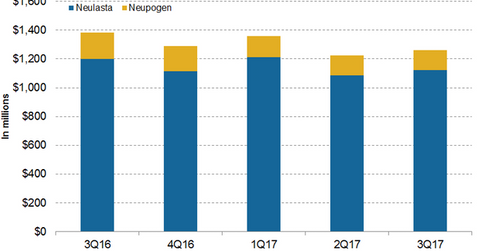

How Did Amgen’s Neulasta and Neupogen Perform in 3Q17?

In 3Q17, Amgen’s (AMGN) Neulasta generated revenues of around $1.1 billion, a ~6% decline on a year-over-year (or YoY) basis and ~3% growth on a quarter-over-quarter basis.

Nov. 2 2017, Updated 7:32 a.m. ET

Neulasta revenue trends

In 3Q17, Amgen’s (AMGN) Neulasta generated revenues of around $1.1 billion, a ~6% decline on a year-over-year (or YoY) basis and ~3% growth on a quarter-over-quarter basis. In 3Q17, Neulasta generated revenues of around $977 million in the US markets compared to $1.0 billion in 3Q16. In 3Q17, Neulasta generated revenues of around $146 million in markets outside the US compared to $176 million in 3Q16.

The decline in unit demand was primarily a result of the decrease in Neulasta revenues in 3Q17 compared to 3Q16. In 3Q17, in US markets, Neulasta Onpro kit’s share rose to 56% of net US Neulasta units. Neulasta (pegfilgrastim) is used to diminish the incidence of infection in patients with non-myeloid cancers who are receiving myelosuppressive anti-cancer drugs.

Neupogen revenue trends

In 3Q17, Amgen’s Neupogen generated revenues of around $138 million, which reflected a ~25% decline on a YoY basis and ~1% growth on a quarter-over-quarter basis. In 3Q17, Neupogen generated revenues of around $96 million, a 24% decline on a YoY basis, in the US compared to $127 million in 3Q16. In 3Q17, outside the US market, Neupogen generated revenues of around $42 million compared to $56 million in 3Q16. In 3Q17, outside the US market, Neupogen witnessed a ~25% decline on a YoY basis.

Neupogen (filgrastim) is used to diminish the possibility of infection due to a low white blood cell count in individuals with a certain type of cancer who are receiving chemotherapy. Amgen’s Neupogen competes with Teva Pharmaceuticals’ (TEVA) Granix, Novartis’s (NVS) Zarxio, and Sanofi’s (SNY) Leukine. The iShares Nasdaq Biotechnology ETF (IBB) invests ~8.0% of its total portfolio holding in Amgen.