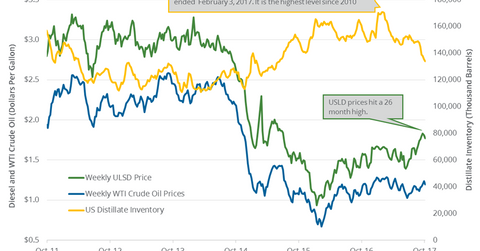

US Distillate Inventories Fell for the Seventh Time in 8 Weeks

US diesel futures fell on October 25, 2017, despite the massive fall in distillate inventories. They fell 0.2% to $1.81 per gallon on the same day.

Oct. 26 2017, Published 10:49 a.m. ET

US distillate inventories

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 5,300,000 barrels or 4% to 129.2 MMbbls (million barrels) on October 13–20, 2017. The inventories have fallen by 23.2 MMbbls or 15.2% from the same period in 2016.

Wall Street analysts expected that US distillate inventories would have fallen by 860,000 barrels on October 13–20, 2017. US diesel futures fell on October 25, 2017, despite the massive fall in distillate inventories. They fell 0.2% to $1.81 per gallon on the same day. Similarly, US crude oil (USO) (SCO) prices fell on October 25, 2017.

Changes in diesel and oil (DBO) (UCO) prices impact oil producers (VDE) (FXN) and refiners (CRAK) like Northern Tier Energy (NTI), PBF Energy (PBF), QEP Resources (QEP), and W&T Offshore (WTI).

US distillate production and demand

According to the EIA, US distillate production rose by 9,000 bpd (barrels per day) to 4,795,000 bpd on October 13–20, 2017. The production had risen 259,000 bpd or 5.7% from the same period in 2016.

US distillate demand rose by 624,000 bpd or 18% to 4,101,000 bpd on October 13–20, 2017. However, the demand fell 1.5% or 65,000 bpd from the same period in 2016.

Impact

US distillate inventories fell for the seventh time in the last eight weeks. They have fallen by 19.1 MMbbls or 13% in the last ten weeks. Any fall in distillate inventories could benefit diesel and crude oil (UWT) (DWT) prices.

Read What to Expect from Crude Oil Prices in 2018 for crude oil updates. Also, read Will US Natural Gas Prices Rise This Winter? for natural gas updates.