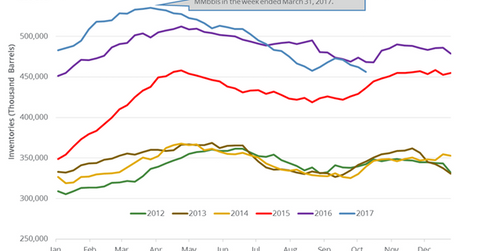

Lower US Crude Oil Inventories Help Crude Oil Bulls

The EIA estimates that crude oil inventories fell by 5.7 MMbbls to 456.4 MMbbls on October 6–13, 2017—the lowest levels since August 25, 2017.

Oct. 19 2017, Updated 3:46 p.m. ET

US crude oil inventories

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on October 18, 2017. It estimates that crude oil inventories fell by 5.7 MMbbls (million barrels) to 456.4 MMbbls on October 6–13, 2017—the lowest levels since August 25, 2017. US inventories have fallen by 12.2 MMbbls or 2.6% from the same period in 2016.

A Wall Street Journal survey estimated that US crude oil inventories would have fallen by 3.2 MMbbls on October 6–13, 2017. US crude oil (DWT) (SCO) (OIL) prices rose on October 18, 2017, due to the larger-than-expected fall in US crude oil inventories.

US oil (UCO) (UWT) prices are at a three-week high. They have risen 10% in the last three months due to several bullish drivers. Changes in oil prices impact oil producers like (FXN) (OIH) like EOG Resources (EOG), Stone Energy (SGY), and Denbury Resources (DNR).

US crude oil inventories by region

The EIA divides the US into five storage regions. Let’s assess the changes in crude oil inventories on October 6–13, 2017.

- East Coast inventories rose by 1.3 MMbbls to 13.4 MMbbls.

- Midwest inventories rose by 1.8 MMbbls to 151.1 MMbbls.

- Gulf Coast inventories fell by 8.9 MMbbls to 223.2 MMbbls.

- Rocky Mountain inventories were flat at 20.2 MMbbls.

- West Coast inventories rose by 0.1 MMbbls to 48.6 MMbbls.

Impact of US crude oil inventories

US crude oil inventories are 18% above their five-year average for the week ending October 13, 2017. High nationwide crude oil inventories could pressure oil (DBO) (OIL) prices. Moves in oil prices impact oil producers (XLE) (VDE) like Stone Energy and Denbury Resources.

In the next part, we’ll discuss how Hurricane Nate impacted US crude oil production.