Why US Crude Oil Inventories Rose Again

On September 13, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report.

Sep. 14 2017, Published 2:10 p.m. ET

Crude oil inventories

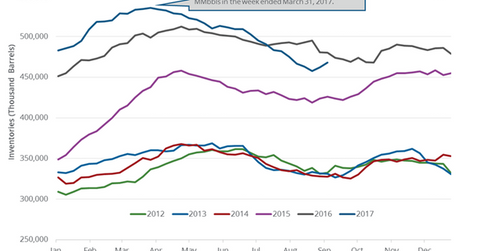

On September 13, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report. It reported that US crude oil inventories rose by 5.8 MMbbls (million barrels) to 468.2 MMbbls from September 1 to 8. Inventories rose 1.3% week-over-week but fell 11.2 MMbbls or 2.5% year-over-year.

A market survey estimated that US crude oil inventories would have risen 3.2 MMbbls from September 1 to 8. US crude oil (DBO)(DIG)(SCO) prices rose on September 13 despite the larger-than-expected rise in inventories.

Changes in crude oil (IXC)(IYE) prices impact oil and gas producers such as QEP Resources (QEP), Hess (HES), and PDC Energy (PDCE).

US refinery crude oil demand

US refinery crude oil demand fell by 394,000 bpd (barrels per day) to 14,078,000 bpd from September 1 to 8. Refinery demand fell 2.7% week-over-week and 2,652,000 bpd, or 15.8%, year-over-year. US refinery crude oil demand fell 20% or 3,647,000 bpd in the last two weeks due to Hurricane Harvey. The fall in refinery demand led to the rise in US crude oil inventories for the last two weeks. The rise in US crude oil production last week could have also contributed to the rise in US crude oil inventories.

US crude oil imports

US crude oil imports fell by 603,000 bpd to 6,480,000 bpd from September 1 to 8. Imports fell 8.5% week-over-week and 1,582,000 bpd or 20% year-over-year. US crude oil imports fell in the last two weeks due to Hurricane Harvey.

US crude oil exports

US crude oil exports rose by 621,000 bpd to 774,000 bpd from September 1 to 8. Exports rose 356,000 bpd or 85% year-over-year. US crude oil exports fell 749,000 bpd to 153, 000 bpd between August 25 and September 1 due to Hurricane Harvey.

Impact of US crude oil inventories

US crude oil inventories are at a five-week high. They’re above their five-year average by 24% for the week ending September 8. A rise in US crude oil inventories could pressure crude oil (SCO)(BNO) prices.

In the next part of this series, we’ll look at how US crude oil production impacts crude oil prices.