Distillate Inventories: More Bullish News for Oil

The US Energy Information Administration (or EIA) released its weekly crude oil and gasoline inventory report on September 20, 2017.

Nov. 20 2020, Updated 11:25 a.m. ET

US distillate inventories

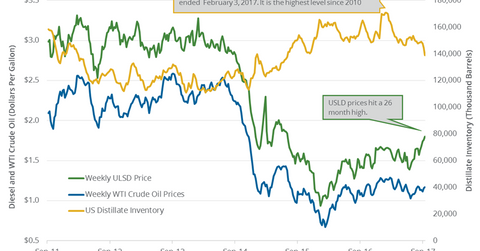

The US Energy Information Administration (or EIA) released its weekly crude oil and gasoline inventory report on September 20, 2017. It estimates that US distillate inventories fell by 5.7 MMbbls (million barrels), or 4%, to 138.9 MMbbls between September 8 and September 15, 2017, which was the biggest weekly draw since November 2011. Inventories are down 26.1 MMbbls, or 15.8%, from the same period in 2016.

A market survey had earlier estimated that US distillate inventories would have fallen 1.6 MMbbls between September 8, 2017, and September 15, 2017. US diesel futures rose 1.9% and closed at $1.80 per gallon on September 20, 2017. It is the highest level since July 2015. Diesel and US crude oil (SCO) (USO) (UWT) prices rose on September 20, 2017, due to the massive fall in distillate inventories.

Higher diesel prices have a positive impact on the earnings of refiners (CRAK) such as Phillips 66 (PSX), Tesoro (TSO), and Valero (VLO). Likewise, higher crude oil prices have a positive impact on the earnings of oil producers (RYE) (VDE) such as Chevron (CVX), Bill Barrett (BBG), and Bonanza Creek Energy (BCEI).

US distillate production, imports, and demand

US distillate production rose by 570,000 bpd (barrels per day) to 4.5 MMbpd (million barrels per day) between September 8, 2017, and September 15, 2017. However, production fell 435,000 bpd, or 8.7%, during the same period in 2016.

US distillate imports fell 51,000 bpd to 85,000 bpd between September 8, 2017, and September 15, 2017. However, imports rose 9,000 bpd, or 12%, during the same period in 2016.

US distillate demand rose by 207,000 bpd, or 5.1%, to 4.2 MMbpd between September 8, 2017, and September 15, 2017. Demand rose 833,000 bpd, or 24.3%, during the same period in 2016. This is a bullish sign for diesel and crude oil prices.

Impact

US distillate inventories are down by 12.5 MMbbls, or 8.3%, in the last ten weeks. According to the latest data, inventories fell for the third consecutive week. A fall in distillate inventories could benefit diesel and even crude oil (USO) (UCO) prices.

To learn more about crude oil price forecasts, read Hedge Funds Are Turning Bearish on US Crude Oil.

Read Are Crude Oil Futures Signaling a Breakout? and How Major Oil Producers and the Dollar Are Driving Crude Prices for more on crude oil.

Read Are US Natural Gas Supply and Demand Rebalancing? for updates on natural gas.