Will Global Oil Consumption Beat Production?

WTI (West Texas Intermediate) crude oil (PXI)(USL)(SCO) futures contracts for September delivery fell 0.1% and were trading at $48.78 per barrel in electronic trading at 2:00 AM EST on August 14, 2017.

Aug. 14 2017, Published 2:50 p.m. ET

Crude oil futures

WTI (West Texas Intermediate) crude oil (PXI)(USL)(SCO) futures contracts for September delivery fell 0.1% and were trading at $48.78 per barrel in electronic trading at 2:00 AM EST on August 14, 2017.

US crude oil prices are near a two-month high due to the expectation of improving global crude oil demand. Higher crude oil (XLE)(XOP)(USO) prices have a positive impact on oil and gas exploration and production companies such as Sanchez Energy (SN), Chevron (CVX), and Goodrich Petroleum (GDP).

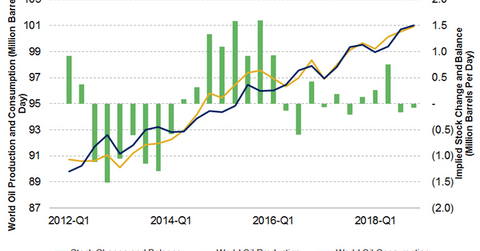

Global oil production and consumption balance

The EIA (U.S. Energy Information Administration) estimates that global oil production rose by 1.13 MMbpd (million barrels per day) to 98 MMbpd in Q2 2017 compared to Q1 2017.

The EIA estimates that global oil consumption rose by 0.88 to 97.8 MMbpd in Q2 2017. The global oil production and consumption balance was at 0.18 MMbpd in Q2 2017.

The EIA estimates that global oil consumption could surpass production in Q3 2017. Global oil consumption would be 0.21 MMbpd higher than production in Q3 2017. It would support crude oil prices. Higher crude oil prices have a positive impact on oil and gas producers such as Sanchez Energy (SN) and Goodrich Petroleum (GDP).

IEA expects strong oil demand growth rate

On August 11, 2017, the International Energy Agency (or IEA) reported that global oil demand would grow at a better-than-expected rate. It expects global crude oil demand to grow by 1.5 MMbpd in 2017. It’s 0.1 MMbpd higher than previous estimates. The rise in demand would reduce excess crude oil. Consequently, it would help rebalance the oil market and support crude oil (IEZ)(XES) prices.

In the next part of this series, we’ll look at the relationship between crude oil and the US dollar.