What Do TripAdvisor’s Key Metric Trends Suggest?

TripAdvisor’s (TRIP) average monthly unique visitors in 2Q17 rose 18.0% YoY (year-over-year) to 414.0 million users compared to 2Q16.

Aug. 10 2017, Updated 3:36 p.m. ET

TripAdvisor’s unique visitor growth is flat

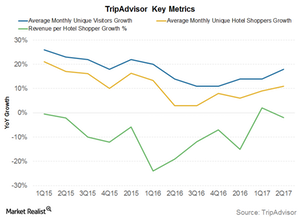

TripAdvisor’s (TRIP) average monthly unique visitors in 2Q17 rose 18.0% YoY (year-over-year) to 414.0 million users compared to 2Q16. For the first half of 2017, unique visitor growth has averaged 16.0% YoY. For 2016, monthly unique visitors grew 14.0% YoY to 351.0 million users.

Hotel shoppers grew

Average monthly hotel shoppers grew 11.0% YoY to 153.0 million in 2Q17. Growth in the first half of 2017 averaged 10.0% YoY compared to the 6.0% YoY growth in 2016 and the 13.0% YoY growth in 2015. This trend reversal will be good news for TRIP, as hotels make up almost 80.0% of its revenue.

Revenue per shopper continues to decline

Revenue per shopper continued to decline in 2Q17 by 2.0% to $0.47. That’s better than the 2016 decline of 15.0% YoY to $0.46. However, the good news is that the hotel shopper volume has risen 11.0% YoY due to growth in mobile shoppers and non-US market growth.

Huge content growth

User reviews on the company’s website grew 40.0% YoY during the quarter to 535.0 million reviews on 7.3 million places to stay, places to eat, and things to do. This huge growth has helped create the TripAdvisor brand and continues to drive users to the website.

Outlook

TripAdvisor’s unique visitors are expected to continue to grow as more and more users shift to booking travel online and through mobiles. For 2017, TRIP management will focus on growing revenue per hotel shopper, which is a key business metric. According to the company, “Our focus remains on leveraging our ongoing product and marketing work to grow this key metric over the long-term.”

Investors can gain exposure to TripAdvisor by investing in the First Trust Dow Jones Internet ETF (FDN), which holds 1.6% in TRIP. It also holds 3.1% in Expedia (EXPE), but it has no holdings in either Priceline (PCLN) or Ctrip.com International (CTRP).

Next, let’s see whether TRIP’s shopper growth has translated to revenue growth.