How Does Cabela’s Compare to Its Peers?

Cabela’s peers have outperformed the company based on PBV. However, Cabela’s has outperformed its peers based on PE and PS.

Oct. 31 2016, Updated 4:04 p.m. ET

Cabela’s and its peers

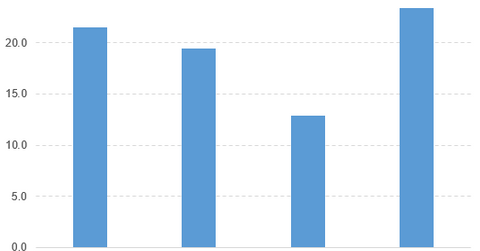

We’ve looked at Cabela’s (CAB) 3Q16 results. Now let’s compare CAB with its peers as of October 28, 2016. First, let’s compare PE (price-to-earnings) ratios:

Now let’s look at PBV (price-to-book value) ratios:

Finally, let’s compare PS (price-to-sales) ratios:

According to the above findings, Cabela’s peers have outperformed the company based on PBV. However, Cabela’s has outperformed its peers based on PE and PS.

ETFs that invest in Cabela’s

The SPDR S&P Retail ETF (XRT) invests 1.2% of its holdings in Cabela’s. The ETF tracks a broad-based, equal-weighted index of stocks in the US retail industry.

The First Trust Mid-Cap Core AlphaDex ETF (FNX) invests 0.22% of its holdings in Cabela’s. The ETF seeks to outperform the US mid-cap sector by choosing stocks from the S&P MidCap 400 Index based on fundamental growth and value factors.

The SPDR S&P 400 Mid Cap Value ETF (MDYV) invests 0.33% of its holdings in Cabela’s. The ETF tracks a market-cap-weighted index of US stocks. The index uses three factors to select value stocks from the 400 stocks chosen by the S&P Committee.

Comparing Cabela’s and its ETFs

Now let’s compare CAB with the ETFs that invest in it. Below are their year-to-date price movements:

- CAB: 32.2%

- XRT: -1.6%

- FNX: 5.6%

- MDYV: 10.5%

Now let’s look at their PBV ratios:

- CAB: 2.2x

- XRT: 3.1x

- FNX: 2.1x

- MDYV: 1.7x

According to the above findings, Cabela’s has mostly outperformed the ETFs based on price movement and PBV.