Why Mining Stocks Are Rising post-Brexit

Friday was important. Gold rose to a two-year high due to additional haven bids on the Brexit referendum.

Jun. 27 2016, Published 1:04 p.m. ET

Miners followed gold

Most mining companies reversed their 2015 losses during the first few months of 2016, posting substantial gains. The correlation between mining stocks and gold remains high. Most miners surged following the gains in gold. Friday was important. Gold rose to a two-year high due to additional haven bids on the Brexit referendum. Almost all mining stocks rose on Friday.

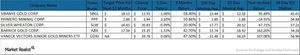

First Majestic Silver (AG), Agnico-Eagle Mines (AEM), Yamana Gold (AUY), and Coeur Mining (CDE) have risen about 300%, 97.9%, 174.2%, and 301.2%, respectively, on a YTD (year-to-date) basis.

The VanEck Vectors Gold Miners ETF (GDX) has risen 94.7% YTD. Due to the sudden substantial increases in mining stocks, many were trading close to or above their target prices. However, many miners are still below their target prices. The above four miners are trading substantially above their target prices, which suggests a possible downturn. All the four stocks saw huge gains due to the Brexit vote.

Technical indicators

First Majestic, Agnico Eagle, Yamana Gold, and Coeur Mining are trading at massive premiums of 59.6%, 26.7%, 34.6%, and 58.8%, respectively, to their 100-day moving averages. A massive premium over a trading price suggests a possible drop in price.

The RSI (relative strength index) readings for these four miners and most other miners have fallen considerably due to gold’s price drop. An RSI level above 70 indicates that a stock has been overbought and could fall. An RSI level below 30 indicates that a stock has been oversold and could rise. GDX’s RSI is close to 61.