Customer Loyalty and Retention: Key Driver for Apple

Apple (AAPL) has repeatedly stated that it has a very satisfied and loyal customer base. In fiscal 1Q16, Apple experienced a high switch rate from Android (GOOG) to iPhone.

Feb. 23 2016, Updated 1:08 p.m. ET

Strong customer satisfaction and retention rates

Apple (AAPL) has repeatedly stated that it has a very satisfied and loyal customer base. In fiscal 1Q16, Apple experienced a high switch rate from Android (GOOG) to iPhone and expects the same to continue in the future. A small number of users also switched from other smartphone operating systems such as Microsoft (MSFT) and BlackBerry (BBRY) to Apple.

Recent customer surveys by 451 Research measured a 99% customer satisfaction rate for iPhone 6S and 6S Plus and a 97% satisfaction rate for the iPad Air 2. The survey also suggests that the loyalty rate for the iPhone is almost twice as strong as the next highest brand.

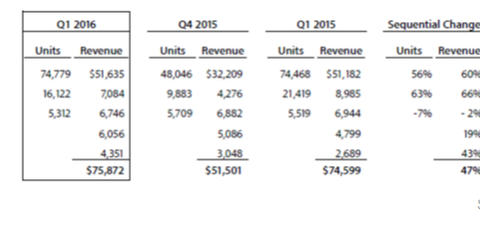

Installed base drives revenues

According to Apple, a growing portion of its revenues is driven by its existing installed base. Since the customer engagement rate is high, Apple spends a lot of time on devices to purchase apps, content, and other services. Customers are also more likely to buy other Apple products or replace the ones they currently own.

As a result, Apple’s installed base is growing at a fast pace and recently crossed the 1 billion active devices milestone for the first time. Driven by impressive growth in its install base, Apple has seen increasing demand and growth of its services business segment, which is also an important source of recurring revenues.

Apple constitutes 16% of the Technology Select Sector SPDR ETF (XLK).