Why Nike Is Projecting Explosive Growth in Retail and Web Sales

Nike’s rival Adidas (ADDYY) is targeting over 2 billion euros from web sales by 2020, as detailed in its latest five-year plan unveiled in March 2015.

Oct. 26 2015, Updated 1:05 a.m. ET

Nike (NKE) comes ahead of direct-to-channel sales projections

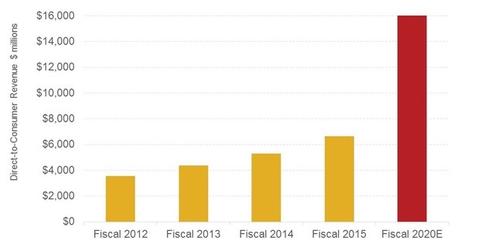

Nike (NKE) plans to grow its direct-to-consumer, or DTC, sales almost 2.5x in the next five years, from $6.6 billion in fiscal 2015, to $16 billion by fiscal 2020. The company beat its own target of $5 billion in DTC sales by fiscal 2015, announced at its last investor day in 2013, by over $1.5 billion.

DTC sales include sales made through the company’s own stores, both factory and in-line, and through nike.com. These channels key drivers of sales for the brand overall. Nike’s company-owned stores, particularly brand statements like the NikeTowns in New York and London, it addition to Nike’s websites, enable Nike to market the brand effectively, thus driving sales across channels, geographies, and categories.

Web sales guidance

Nike.com is expected to be a key driver for DTC sales, with $7 billion in e-commerce sales expected by fiscal 2020.

Online sales came in at ~$1.2 billion in fiscal 2015[1. Internet Retailer estimates for fiscal 2015]. That would take the e-commerce contribution to 14% of sales in fiscal 2020, up from ~3.9% in fiscal 2015.

Global rival Adidas (ADDYY) is targeting over 2 billion euros from web sales by 2020, as detailed in its latest five-year plan unveiled in March 2015. Under Armour (UA) hopes to grow its web sales five-fold by 2018, though it didn’t provide a sales figure at its 2015 Investor Day.

Profitable venture

More importantly, Nike’s e-commerce business is profitable, and a margins enhancer besides. The company is targeting opening more websites in more countries across the globe and providing a superior mobile and seamless omni-channel experience to its consumers. Product customization through NikeiD and its SNKRS app, unveiled earlier in February, enable Nike to provide a premium and unique experience to customers. These features may also enable Nike stay ahead of up and coming footwear brands like Skechers (SKX), reporting over 36% growth in sales in its last quarter.

The DTC channel, by providing a superior customer experience both in-store and online, enables Nike to charge premium prices. DTC sales also avoid the additional layer of distribution present in the wholesale channel.

Nike makes up 0.4% of the portfolio holdings in the Vanguard S&P 500 ETF (VOO), and 0.2% of the holdings in the Guggenheim S&P 500 Equal Weight ETF (RSP).