The ‘Icahn Lift’: What Companies Have Gained from It?

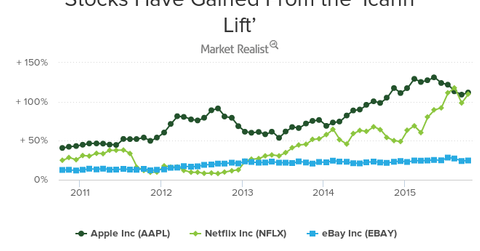

Market commentators have noticed that when Icahn starts buying into a company, its stock prices rise. This trend has been called the “Icahn Lift.”

Nov. 20 2020, Updated 3:43 p.m. ET

Carl Icahn issues a warning

Carl Icahn, legendary activist investor, and founder and chairman of ~$9.5 billion Icahn Enterprises, recently released a video titled “Danger Ahead: A Message from Carl Icahn,” warning America of significant danger ahead.

As an activist investor, Icahn is quite known to shake up companies. Icahn manages over $31 billion of funds. His portfolio is heavily weighted towards the industrial (XLI) and information technology (XLK) sectors. Icahn has a good 31.2% of his portfolio invested in his own company, Icahn Enterprises (IEP), 21.2% in Apple (AAPL), and 8.9% in both eBay (EBAY) and CVR Energy (CVI). Recently, Icahn has been bullish on natural gas company Cheniere Energy (LNG). As of September 28, Icahn owned 11.4% of the company.

Icahn exited his Netflix (NFLX) holding in June this year, cashing in $1.6 billion in profits gained over the three years he remained invested in the stock. Icahn held about 1.4 million shares as of March 31, 2015. Icahn had bought the Netflix (NFLX) stock at an average price of $58 back in 2012. By June this year, the price had soared to around $95.

Companies have gained from the “Icahn Lift”

Icahn seems to have an eye for identifying potential in and making good money out of companies on Wall Street. He is also well known for his assessment of what a company should do. Icahn has been part of, and to some extent behind:

• Oracle’s (ORCL) takeover of the business intelligence development company BEA Systems

• Google’s acquisition of Motorola Mobility

• Apple’s (AAPL) share buyback program

• PayPal’s spin-off from eBay

[marketrealist-chart id=725988]

Carl Icahn’s reputation on Wall Street remains unmatched. In fact, market commentators have noticed that when Icahn starts buying into a company, its stock prices start rising. This trend has been called the “Icahn Lift.” Icahn is known for investing in companies he believes to be undervalued and creating a plan to fix their problems, which causes their stocks to rally. His popular moves include spinning off profitable segments, changing management, and recommending cost cuts and buybacks.

The investment community is eager to hear Icahn’s views on the economy and where it’s heading. In this series, we’ll discuss Carl Icahn’s recent views on the US economy and where it’s heading.