What Do Yield Spreads between 2-Year and 10-Year Notes Indicate?

While a section of the market is readying itself for a rate hike in the upcoming meeting of the FOMC, there are others who don’t believe that a rate hike would be implemented and instead, are focused on falling inflation.

Sep. 15 2015, Updated 1:35 p.m. ET

What are yield spreads?

Yield spreads refer to the difference between the yields of two fixed income securities. They can either be of the same or different credit quality. In this article, we’ll look at yield spreads between Treasury securities. Spreads are measured in basis points. One basis point equals 1/100th of a percentage point, so 1.0% equals 100 basis points.

Yield spreads between different maturity Treasury securities, when compared to historical trends, can indicate how market participants view economic conditions.

Broadly speaking, rising, or widening, spreads lead to a positive yield curve, thus indicating stable economic conditions in the coming time. Contracting, or falling spreads, on the other hand, may indicate worsening economic conditions in the future, resulting in a flattening yield curve.

How do spreads look currently?

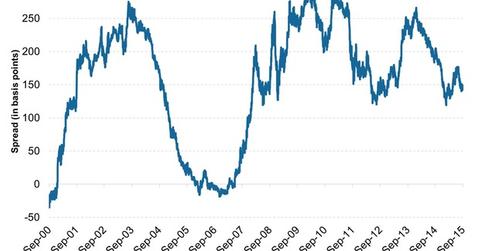

In the above graph, we have provided spreads between two- and ten-year Treasury notes.

In the 16-year period that we have examined, yield spreads between two- and ten-year notes had fallen to a low of -35 basis points in September 2000. This was in line with the worsening economic conditions that followed. By February 2011, yield spreads between these notes had risen to 291 basis points. As of September 11, these spreads are down to 149 basis points.

What is the reason for this fall?

A primary reason for this fall is mixed expectations by market participants. While a section of the market is readying itself for a rate hike in the upcoming meeting of the FOMC (Federal Open Market Committee), there are others who don’t believe that a rate hike would be implemented and instead, are focused on falling inflation. The former are leading to a rise in the short end of the yield curve while the latter lead to a fall in the long term. This has helped decrease yield spreads.

Inflation expectations have been a key driver, not only for Treasuries, but also for investment-grade bonds and related mutual funds like the Oppenheimer Core Bond Fund (OPIGX) and the Vanguard Total Bond Market Index Fund (VBMFX). The latter invests into bond issues of companies like Allergan PLC (AGN), American Airlines Group (AAL), and Oracle (ORCL).

In the next article, let’s examine three scenarios regarding changes in federal funds rate and their impact.