A Geographic Overview of Toll Brothers’ Homebuilding Operation

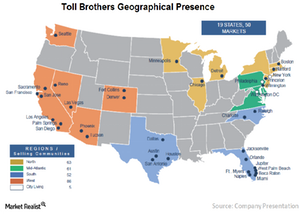

Toll Brothers (TOL) has a very geographically diverse homebuilding operation in the United States. The company has a presence in 50 markets, spanning 19 states as well as the District of Columbia.

Sep. 23 2015, Updated 11:05 a.m. ET

Homebuilding divisions

Toll Brothers’ (TOL) homebuilding operations are divided into five segments: North, Mid-Atlantic, South, West, and City Living.

Toll Brothers (TOL) has a very geographically diverse homebuilding operation in the United States. The company has a presence in 50 markets, spanning 19 states as well as the District of Columbia.

With 47,200 home sites owned and controlled around the country, the company has a diverse portfolio of current and future communities.

Entry into high-growth markets

Since the 1990s, Toll Brothers (TOL) has been a dominant luxury homebuilding company in the northeast and mid-Atlantic suburban corridor, extending from metro Washington, DC, to metro Boston. This corridor is the most affluent and densely populated corridor in the United States.

In recent years, the company has focused on diversifying and expanding its presence in several other high-growth markets, particularly coastal California, Texas, and urban New York.

Entry into coastal California

With the acquisition of Shapell Homes in 2014, Toll Brothers (TOL) gained 5,000 home sites in established communities in the coastal California markets surrounding Los Angeles and San Francisco.

The acquisition boosted Toll Brothers’ (TOL) California community count significantly, particularly in the San Francisco suburbs, where its land supply had dwindled due to cautious buying as home site prices escalated.

City Living division

Toll Brothers’ City Living division, which is mainly concentrated in the metro New York City market, is a key driver of growth and profits. The company entered this market a decade ago. Since then, it has steadily built Toll Brothers City Living as a condominium-focused brand.

Currently, Toll Brothers City Living has 837 units in open or soon-t0-be-open projects, with another 1,203 units making their way through the approval process.

Geographic diversification

Toll Brothers (TOL) is one of the more geographically diversified major homebuilders in the United States. Other major competitors, such as Lennar (LEN) and D.R. Horton (DHI), operate in 18 and 27 states, respectively. Toll Brothers’ geographic diversification lowers its operational risks by mitigating the effects of local and regional economic cycles.

Investors looking for diversification in the homebuilding sector can consider ETFs like the SPDR S&P Homebuilders ETF (XHB) and the iShares US Home Construction ETF (ITB). Toll Brothers (TOL) forms 7.78% of the holdings of the iShares US Home Construction ETF (ITB).

In the next part of our series, we’ll delve into Toll Brothers’ land acquisition strategy.