Gilead Sciences: Investor’s Overview of a Leading Biotech Company

The strong leadership of Gilead’s talented scientists has enabled the company to consistently deliver innovative therapies in the market.

Aug. 19 2015, Published 2:52 p.m. ET

Overview

Based in Foster City, California, Gilead Sciences (GILD) is a leading biotechnology company. The company is involved in discovering, developing, and commercializing innovative therapies. Gilead has the highest market capitalization in the biotechnology industry, amounting to about $175.8 billion. Peers Amgen (AMGN), Celgene (CELG), and Biogen (BIIB) have market capitalizations of about $134.5 billion, $105.3 billion, and $79.3 billion, respectively.

History

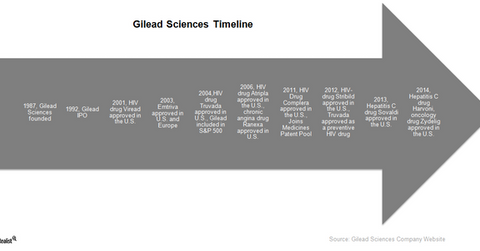

Gilead Sciences was founded in June 1987 by a medical doctor, Michael L. Riordan from Johns Hopkins School of Medicine and Harvard Business School. He was joined by three scientific advisers: Peter Dervan of Caltech, Doug Melton of Harvard, and Harold Weintraub of Fred Hutchinson Cancer Research Center. The strong leadership of talented scientists has enabled the company to consistently deliver innovative therapies in the market.

Successful drugs

Gilead Sciences’ antifungal drug AmBisome received its first approval in Europe in 1990. In January 1992, the company completed its initial public offering worth $86.25 million. The next major drug breakthrough was witnessed in 1999, when Tamiflu for influenza A and B in adults was approved in the US. In 2000, AmBisome was approved for treating brain-related fungal infections in US patients with HIV.

The year 2001 introduced Viread, a major innovation in the HIV market. The following year, Viread was also approved in Europe. The next decade proved extremely successful for Gilead as it launched successful drugs in quick succession. HIV drugs such as Emtriva, Truvada, Atripla, Complera, and Stribild were introduced in the market, in both the US and Europe. These drugs have made Gilead the market leader in HIV medication.

In 2013, Gilead introduced Sovaldi, a drug that has revolutionized hepatitis C treatment. This was followed in 2014 by Harvoni, an improved version of Sovaldi. The innovative technology, coupled with high pricing, has led to Gilead registering bumper profits in these two years. In 2014, Gilead also introduced Zydelig, an innovative medication for chronic lymphocytic leukemia, marking its entry in the lucrative oncology market.

Investors can gain exposure to the strong drug portfolio of Gilead Sciences while avoiding company-specific risks by investing in iShares Nasdaq Biotechnology ETF (IBB). Gilead accounts for 7.89% of IBB’s total holdings.