What The Supercenter Format Contributes To Walmart

Walmart (WMT) has been concentrating on expanding the store count of its larger supercenter format. A supercenter averages ~179,000 square feet in size.

Feb. 20 2015, Updated 2:05 p.m. ET

Mulling the size advantage

As mentioned in the last part of this series, Walmart (WMT) has been concentrating on expanding the store count of its larger supercenter format. A supercenter averages ~179,000 square feet in size.

Between 1Q10 and 3Q15, the number of supercenters rose by 650. There was a net decline of 409 in the mid-sized discount store count in the US. Walmart is evaluating or planning additional real estate options at about half of its discount stores. These stores would either be converted to superstores, revamped, or closed.

Why supercenters?

The shift towards larger stores fulfills multiple objectives for the retailer. First, the market size for the segment is estimated at $585 billion—the largest among all of the store formats[1. IRI Consumer Panel data for 52 weeks ended July 14, 2013, Walmart filings]. Second, it gives the company the opportunity to provide its full array of merchandise. Third, a robust network of supercenters allows the retailer to use these as fulfillment centers for its online sales. It can also use the supercenters as distribution points for its smaller-format stores.

Walmart plans to roll out about 120 new supercenters in fiscal year 2015. It plans to open 60–70 new supercenters in fiscal year 2016. This includes converting existing discount stores to the supercenter format.

Market share

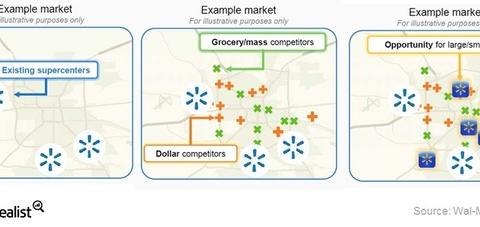

Walmart’s scale means getting revenue to move. This is a huge effort. In this environment, it’s important that the retailer continues to seek opportunities to expand its market share in areas where it thinks customers aren’t being served effectively.

Walmart believes that both the Neighborhood Market and supercenter formats will likely provide valuable fill-in opportunities. This will help Walmart compete effectively with other retail companies—like Kroger (KR), Safeway (SWY), Dollar General (DG), Dollar Tree (DLTR), and Family Dollar Stores (FDO).

However, the recent announcement concerning the Dollar Tree acquisition of Family Dollar Stores could disrupt Walmart. For more on how the acquisition could impact Walmart, read Part 28 in this series.

Walmart is the largest holding in the VanEck Vectors Retail ETF (RTH) with an ~10.9% weight. The top ten holdings in RTH also include Costco (COST) with a 4.8% weight—it’s seventh. Target (TGT) is tenth with a 4.3% weight.